When it comes to financial growth, both savings and credit play important roles. But the question is: which one actually helps build your future faster? The answer depends on how you use them. Let’s explore both sides and find out how to create a smart balance for long-term success.

🔵 Savings: The Foundation of Financial Security

What is savings?

Savings means setting aside a portion of your income for future use — like emergencies, investments, or life goals.

Benefits of savings:

- Emergency protection – Gives you a cushion during job loss, illness, or sudden expenses.

- Peace of mind – Reduces stress by giving you control over your money.

- Earns interest – Bank savings or investments can grow over time.

- Helps avoid debt – You don’t need to borrow for small or medium expenses.

Examples of smart saving:

- Building a 3–6 month emergency fund

- Saving for a car or higher education

- Monthly deposits in a high-interest savings account or mutual fund

🟢 Bottom line: Savings builds your foundation, keeps you safe, and gives you freedom of choice.

🔴 Credit: The Tool for Growth (If Used Wisely)

What is credit?

Credit means borrowing money (like loans or credit cards) with a promise to repay later, usually with interest.

Benefits of credit:

- Opportunity to grow – You can start a business, buy a house, or invest before you have full cash.

- Builds credit score – A good credit history opens doors to better loans and lower interest rates.

- Convenience and flexibility – Useful for travel, online shopping, or emergencies.

Risks of bad credit use:

- High interest debt – Unpaid credit cards can trap you in debt.

- Poor credit score – Late payments affect your future borrowing.

- Overspending – It’s easy to buy more than you can afford.

Examples of smart credit use:

- Taking a student loan for a degree that increases your income potential

- Using a credit card for regular expenses and paying it off fully each month

- Business loans that generate more profit than the interest you pay

🟢 Bottom line: Credit can be a ladder to success if used with discipline and a clear repayment plan.

⚖️ Savings vs Credit: Which Builds Your Future Faster?

| Criteria | Savings | Credit |

|---|---|---|

| Risk level | Low | Medium to High |

| Growth potential | Slow but steady | Fast if used wisely |

| Builds credit history | No | Yes |

| Emergency support | Yes | Yes, but with cost |

| Financial independence | Strong | Dependent on repayments |

| Ideal for students | Daily expenses, tuition fund | Education loans, laptops |

| Ideal for entrepreneurs | Starting capital | Business loans, scaling up |

✅ Key Takeaways

- Start with savings to build a safe financial base.

- Use credit as a tool for specific goals — not for lifestyle upgrades.

- Always spend less than you earn and pay your dues on time.

- Combining both smartly is the fastest way to build your future.

📌 Final Thought

Savings is your safety net. Credit is your growth engine.

Used together, they help you move faster, smarter, and more securely toward your dreams.

⚖️ Savings vs Credit: Which One Builds Your Future Faster? (Explained)

| Criteria | Savings – Description | Credit – Description |

|---|---|---|

| Risk level | Savings means using your own money, so the risk is low. | Credit involves borrowed money. If not repaid on time, it can become risky. |

| Growth potential | Savings grow slowly over time through interest or investment returns. | Credit can lead to faster growth if used wisely, like for business or education. |

| Builds credit history | Savings don’t help build a credit score. | Responsible credit use (timely repayments) improves your credit score and future access. |

| Emergency support | Savings can be used directly during emergencies without extra cost. | Credit (like credit cards) can be used in emergencies but involves interest or fees. |

| Financial independence | Savings give full independence — you rely on your own money. | Credit creates dependency — you must repay, often with interest. |

| Ideal for students | Best for managing daily expenses, tuition, and savings habits. | Useful for education loans, gadgets (like laptops), or building credit early. |

| Ideal for entrepreneurs | Can help in saving capital before starting a business. | Business loans help scale up quickly — but need a clear plan for repayment. |

✅ Summary of Key Insights:

- Savings = Safety: It provides financial stability and peace of mind.

- Credit = Opportunity: It opens doors to faster growth when used carefully.

- Use both together: Build savings first, then use credit with discipline for faster progress.

💡 Savings vs Credit: What Builds Your Future Faster?

Both savings and credit can shape your financial future — but in different ways. Here’s a deeper look at how they work, their pros and cons, and how you can use them together to grow faster and smarter.

🔵 1. Risk Level

Savings:

- You use your own money.

- There is no repayment pressure or risk of falling into debt.

- It’s safe and stress-free.

Example:

If you save $5,000 over time, you can use it anytime without owing anyone.

Credit:

- You’re using borrowed money.

- If you miss payments, interest charges increase.

- Can lead to debt traps or damaged credit score.

Example:

If you take a $5,000 credit card loan and don’t pay on time, you might owe $6,000+ due to interest and late fees.

🟢 2. Growth Potential

Savings:

- Money grows slowly through interest, investments, or compound returns.

- Best for long-term stability and planning.

Example:

Saving $200/month in a mutual fund may grow to over $10,000 in 4 years, depending on the return rate.

Credit:

- Can accelerate success when used wisely (like investing in education or starting a business).

- Faster than savings when used with a plan.

Example:

Taking a loan to start a profitable business may give you $20,000 return in 1 year — faster than saving.

🟡 3. Building Credit History

Savings:

- Has no direct effect on your credit score.

- But a large savings balance improves your financial profile for future loans.

Credit:

- Essential for building a good credit score.

- A good credit score means:

- Lower interest rates on future loans

- Easier approval for housing or jobs in some countries

Tip: Use a credit card monthly and pay in full to build strong credit without paying interest.

🔴 4. Emergency Support

Savings:

- Acts as a safety net — immediate, stress-free access to cash.

- No extra costs or penalties.

Credit:

- Available instantly (like credit cards), but can become expensive if not repaid soon.

- Better for short-term, urgent needs only.

Pro Tip:

Have both — a small savings fund and a credit card for added security.

🟣 5. Financial Independence

Savings:

- You stay in control of your money.

- No obligations or dependencies.

Credit:

- You’re borrowing someone else’s money, so you’re under obligation to repay.

- Delayed payments can affect your freedom and financial goals.

Real-life impact:

Too much credit use without income can lead to mental stress, loss of assets, or legal issues.

🔶 6. Best Use by Life Stage

| Life Stage | Savings Use | Credit Use |

|---|---|---|

| Students | Emergency fund, exam fees, transportation, books | Student loans, laptop purchase, building credit early |

| Young Professionals | Rent, travel, home appliances, short-term investments | Buying furniture/appliances with EMIs, travel credit cards |

| Entrepreneurs | Initial business capital, stock, office rent | Business expansion, marketing, hiring, large equipment |

| Families | Education, healthcare, vacation, long-term goals | Home loan, car loan, insurance premium payments |

📊 Quick Visual Comparison:

| Feature | Savings | Credit |

|---|---|---|

| Ownership | Your own money | Borrowed money |

| Repayment Needed? | No | Yes (plus interest) |

| Credit Score Impact | None | High (positive or negative) |

| Emergency Use | Yes (best option) | Yes (but expensive) |

| Long-Term Benefit | High (safe, compounding) | High (if planned, risky if misused) |

| Financial Discipline | Encouraged | Required strictly |

✅ Smart Strategy: Use Both

To build your future faster:

- Start with savings: Build a habit and emergency fund (at least 3 months of expenses).

- Use credit wisely: Take only necessary loans. Pay full credit card bills each month.

- Invest saved money: Let it grow through SIPs, fixed deposits, or index funds.

- Track both: Use financial tools to track savings, repayments, and net worth.

🧠 Final Thought

Savings is your shield. Credit is your sword.

When used together — with discipline — they can make you financially powerful.

The goal isn’t to choose one over the other, but to master both wisely.

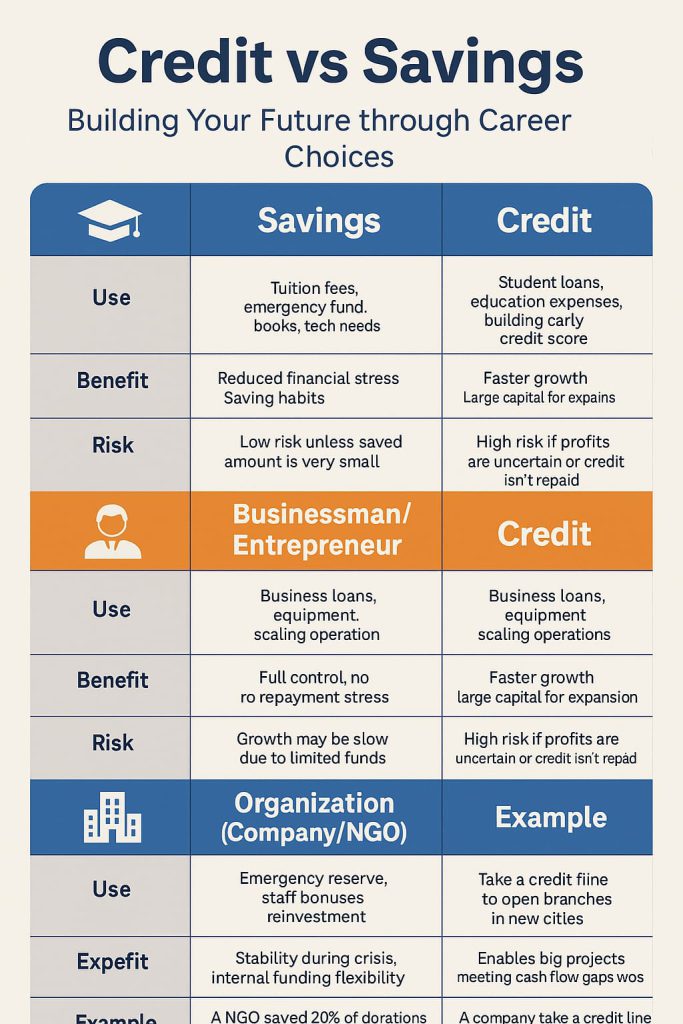

How can students,Businessman and Organizations strategically utilize credit while maintaining savings for long_-term financial stability and growth?

🎓 1. Student: Building Foundation & Credit History

| Aspect | Savings | Credit |

|---|---|---|

| Use | Tuition fees, emergency fund, books, tech needs | Student loans, education expenses, building early credit score |

| Benefit | Reduces financial stress, builds saving habits | Helps afford higher education, early credit use builds history |

| Risk | Low, unless saved amount is very small | Risk of debt if loans aren’t managed after graduation |

| Example | Saving from part-time job for course fees | Using credit card for controlled purchases and repaying on time |

✅ Smart Tip for Students:

Start with savings → Get a student-friendly credit card → Use it monthly & repay fully → Grow credit score early.

💼 2. Businessman/Entrepreneur: Investing for Growth

| Aspect | Savings | Credit |

|---|---|---|

| Use | Initial capital, inventory, emergency buffer | Business loans, equipment, scaling operations |

| Benefit | Full control, no repayment stress | Faster growth, large capital for expansion |

| Risk | Growth may be slow due to limited funds | High if profits are uncertain or credit isn’t repaid |

| Example | Saving $10,000 over 2 years to open a small shop | Taking a $20,000 business loan and expanding to 3 shops in 1 year |

✅ Smart Tip for Entrepreneurs:

Build a savings base first → Use credit for scalable, revenue-generating steps → Track ROI on credit spending.

🏢 3. Organization (Company/NGO): Structured Financial Management

| Aspect | Savings | Credit |

|---|---|---|

| Use | Emergency reserve, staff bonuses, reinvestment | Working capital, expansion loans, infrastructure investment |

| Benefit | Stability during crisis, internal funding flexibility | Enables big projects, meets cash flow gaps without slowing operations |

| Risk | Opportunity cost of holding large savings | Risk of over-leverage, interest burden, dependency |

| Example | NGO saving 20% of donations for future campaigns | Company taking credit line to open branches in new cities |

✅ Smart Tip for Organizations:

Maintain a 6–12 month savings reserve → Use credit for planned expansions or crisis bridging → Keep debt-to-income ratio low.

📊 Comparison Summary

| Role | How Savings Help | How Credit Helps |

|---|---|---|

| Student | Builds discipline, funds essentials | Builds credit early, supports quality education |

| Entrepreneur | Reduces dependence, ensures survival | Speeds up business growth, supports expansion |

| Organization | Provides crisis buffer, funds internal projects | Enables large-scale projects and better cash flow |

🧠 Final Thought:

“Savings protect. Credit accelerates. Smart people use both.”

No matter your stage — student, businessperson, or an organization — the key is:

- Use savings for safety and control

- Use credit for strategic growth with a clear repayment plan

TheFinanceLift Lift Your Finances, One Step at a Time

TheFinanceLift Lift Your Finances, One Step at a Time