In today’s modern world, credit is not just a financial tool—it’s a gateway to opportunities. Whether you’re a student, entrepreneur, employee, or homemaker, understanding and utilizing credit wisely can significantly impact your journey toward success.

# 🌟 UNDERSTANDING CREDIT: WHAT IS IT REALLY? Credit refers to the ability to borrow money or access goods or services with the promise to pay later. It’s used in various forms like credit cards, loans, mortgages, and lines of credit.

# 🌐 WHY IS CREDIT SO IMPORTANT IN LIFE?

- Convenience: Enables purchases without immediate cash.

- Emergency Support: Acts as a safety net in times of financial stress.

- Building a Financial Profile: Good credit history helps in getting better loan deals.

- Business Growth: Entrepreneurs can use credit for startup and expansion.

- Educational Advancement: Enables access to student loans and scholarships.

- Investment Opportunities: Facilitates real estate or stock market entry.

- Global Acceptance: Credit cards are accepted worldwide and useful for travel.

# 🌍 CREDIT AS A GLOBAL SECURITY TOOL FOR JOB MIGRANTS

When migrating or applying for jobs in a foreign country, a strong credit history can serve as a valuable security and trust indicator:

- Visa & Immigration Processing: Some countries (like Canada or the U.S.) may assess financial responsibility as part of visa approval.

- Housing Rentals Abroad: Landlords often check credit scores before approving leases.

- Banking & Loans: Credit history may be required to open accounts, get credit cards, or secure loans overseas.

- Job Background Checks: Employers in developed countries may include financial background checks during recruitment.

- Relocation Services: Good credit can help obtain relocation assistance or favorable terms from international job agencies.

🔹 Tip: If you plan to work abroad, build and maintain a strong credit profile in your home country. International credit transfer services (like Nova Credit) can help carry your history across borders.

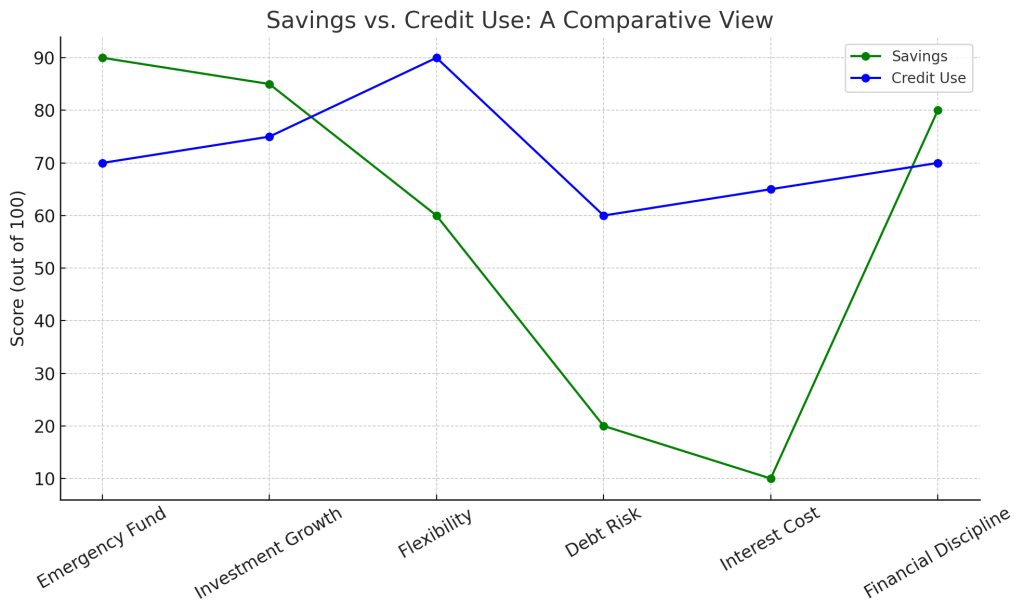

# 📊 THE IMPACT OF CREDIT ON LIFE AND SUCCESS Using credit properly can:

- Help you buy a home or car

- Start or grow a business

- Handle unexpected expenses

- Access better financial products

- Improve financial discipline and literacy

📈 [Insert Bar Chart Here: “How Good Credit Impacts Life Milestones”] (Example: Home ownership, Business Funding, Education Loan Approval)

# 👥 WHO ARE THE PEOPLE MOST CONNECTED TO CREDIT?

- Students: Use credit for education, build history early.

- Employees: Use credit for upskilling and travel.

- Entrepreneurs: Finance business operations.

- Homeowners: Get mortgage or renovation loans.

- Retail Shoppers: Use cards for rewards and cashbacks.

- Freelancers: Manage irregular income flows with credit flexibility.

# 📚 CREDIT UTILIZATION: STUDENTS VS. BUSINESSMEN

Understanding the different credit behaviors of students and businesspeople helps in tailoring smart usage habits:

| Aspect | Student Credit Use | Businessman Credit Use |

|---|---|---|

| Purpose | Education loans, credit card for essentials | Business loans, credit lines for cash flow |

| Loan Size | Small to moderate | Moderate to large |

| Repayment Source | Personal/family or future income | Business revenue |

| Risk Tolerance | Low – prefers safe use | Higher – may take calculated risks |

| Credit Building Goal | Establishing first-time credit history | Expanding financial leverage |

| Common Tools | Student credit card, education loan | Business credit card, working capital loan |

| Benefit if Used Well | Better job offers, early financial independence | Business expansion, tax advantages |

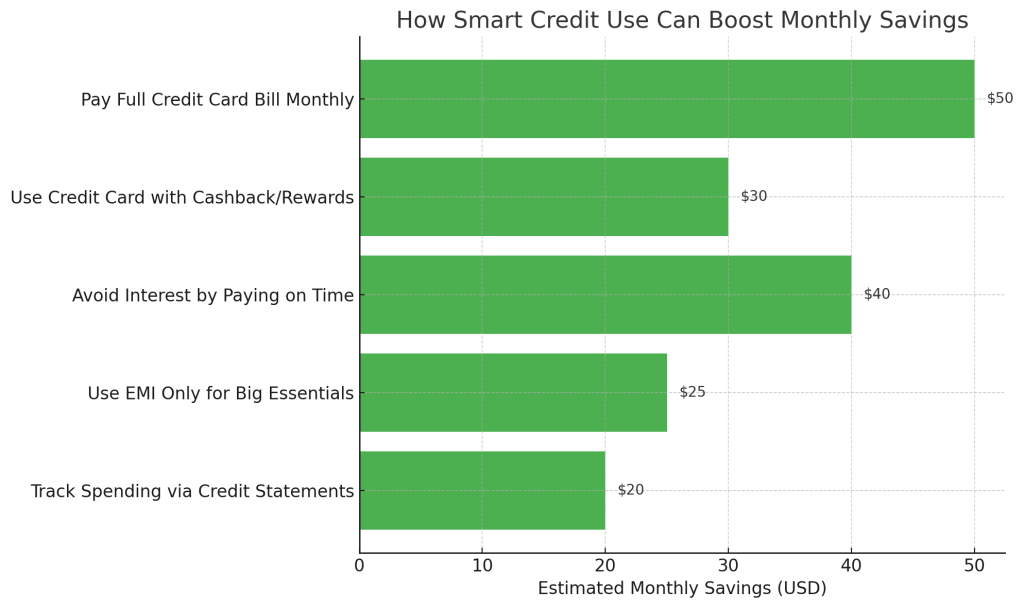

# 🔄 MASTERING THE ART OF SMART CREDIT UTILIZATION

🌿 1. Understand Your Credit Score

- Ranges from 300–850

- Higher score = better loan offers

🔹 Tip: Check your score regularly using apps or credit reports.

🌿 2. Always Pay On Time

- Late payments hurt your score

🔹 Tip: Set reminders or automate payments

🌿 3. Keep Credit Usage Below 30%

- This is called “credit utilization ratio”

🔹 Tip: If your limit is $1,000, try to keep balance under $300

🌿 4. Don’t Take Unnecessary Loans

- Borrow only what you need

🔹 Tip: Avoid falling into debt traps

🌿 5. Monitor Your Credit Report for Errors

- Incorrect data can harm your profile

🔹 Tip: Dispute errors immediately

🌿 6. Diversify Your Credit Types

- Use a mix of credit cards, installment loans, and lines of credit to boost your score.

🔹 Tip: Avoid opening too many new accounts at once.

🌿 7. Stay Within Your Repayment Capacity

- Only take credit you are confident in repaying monthly.

🔹 Tip: Create a credit budget and track it monthly.

# 📅 INSPIRING REAL-LIFE STORIES OF CREDIT SUCCESS

- Sarah, the Entrepreneur: Took a small business loan, now runs a chain of bakeries.

- Jack, the Student: Used education loan wisely, now works in a multinational company.

- Rose, the Homemaker: Used credit card to start an online boutique.

- Jeuice, the Freelancer: Used personal credit during off-seasons to stabilize income.

# 📄 FINAL THOUGHTS: CHOOSE WISELY, GROW STEADILY Credit is a double-edged sword. If used wisely, it opens doors to endless possibilities—if misused, it can trap you in debt. Educate yourself, build good habits, and let credit be your ally on the path to success.

🔍 SMART CREDIT CHECKLIST: YOUR DAILY GUIDE

Stay smart, stay responsible—and let credit help you grow

TheFinanceLift Lift Your Finances, One Step at a Time

TheFinanceLift Lift Your Finances, One Step at a Time